Canadian Mortgage Market Evolution

November 29, 2021

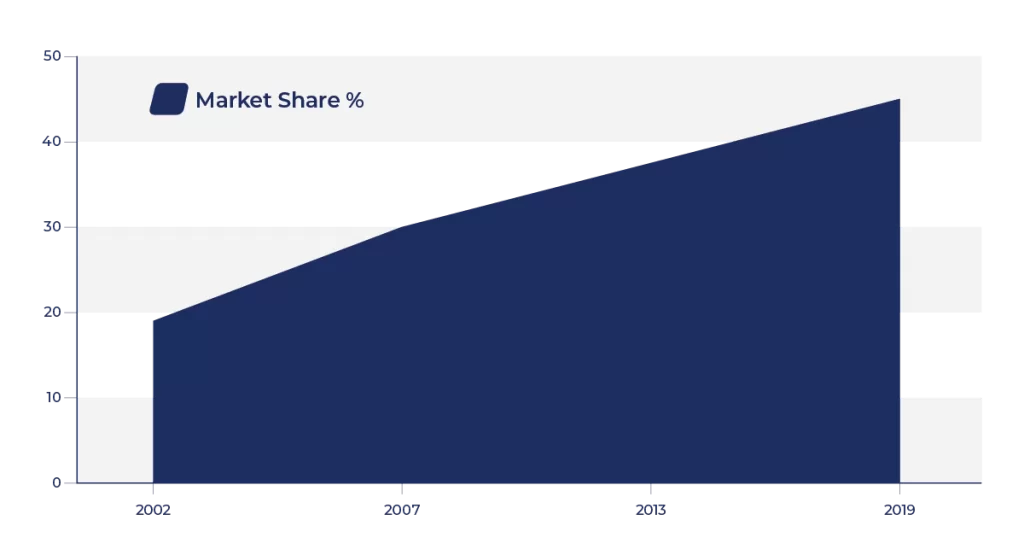

As mortgage products have become more complex the need for independent advice and access to a variety of mortgage products has become a necessity. As a result, digital mortgage brokers have been slowly capturing more and more market share from banks and brick and mortar mortgage originators for the past decade. For Canadian mortgage brokers, the gradual increase in market share from 21% to 47% represents not only more flexible homebuyer attitudes but also is a sign of their growing influence, enhanced services, and increased value of the personal services being offered to first home buyers by digital mortgage originators.

Figure 1: Canada Mortgage Brokers’ Market Share Percentage from 2002 to 2019

The first time homebuyers’ market includes young (e.g., Millennials, Generation Z) homebuyers, immigrant homebuyers, and those who prefer to shop online for better rates and engage in the personal services of the digital brokers for their wealth-building advice, guidance, and support during the ever-increasingly complex mortgage application process.

First Home Buyers

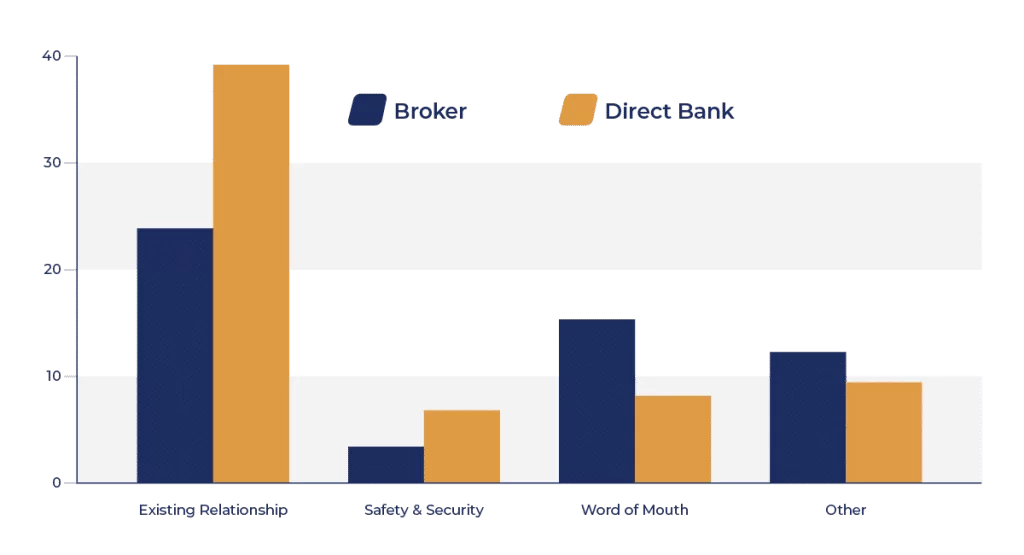

Currently, 55% of first-time homebuyers use digital broker channels. 44% of repeat home buyers use digital broker channels. They often select their brokers based on word of mouth from acquaintances, colleagues, and family members. Others select their digital mortgage brokers based on the professional recommendations of other professionals. Notably, first-time home buyers can be divided into three groups. Each group has different levels of familiarity and comfort with digital mortgage brokers. So, digital mortgage brokers must engage these markets using different strategies.

Figure 2: Existing Relationships Appear Highly Important for Direct Bank Mortgage Borrowers While Word of Mouth Is Relatively More of a Deciding Factor in the Broker Channel

Young Home Buyers: Millennials and Generation Z

Young homebuyers represent a huge market segment for mortgage brokers. They are familiar with IT, working with online professionals, shopping for and comparing services online, and establishing relationships in a non-traditional way. Research shows that although 62% of them are comfortable not having a face-to-face relationship with their mortgage broker they still value human interaction and personalized services. Moreover, this demographic prefers to reach out to mortgage brokers after they have done their own online research. Furthermore, as mortgages increase in complexity, first-time home buyers need professional assistance and emotional support during the application process. Since this trend will continue into the foreseeable future, the role of digital mortgage brokers is expected to continue to grow until it reaches at least 60% market share.

Immigrants

Immigrants are one of the fastest-growing demographics in Canada. In fact, in 2022 and 2023, Canada is expected to increase its immigrant population by 411,000 and 421,000 people, respectively. This is 37% higher than the historic annual average of 303,000 people from 2015 to 2019. Immigrants tend to buy homes two to three years after they have been living in Canada. As the immigrant population grows, it will play a key role in the future mortgage lending market.

Valuing Advice (Increasing Regulations Contribute to Increasing Mortgage Complexity)

There has been a change in how people perceive their primary relationship with their banks and mortgage brokers. In the past, most retail customers would have referred to their bank as the place where they got their mortgage or have their checking and savings accounts. Now, retail customers expect their banks to provide them with valuable financial advice, assistance with increasingly complex financial products, and personalized service and support.

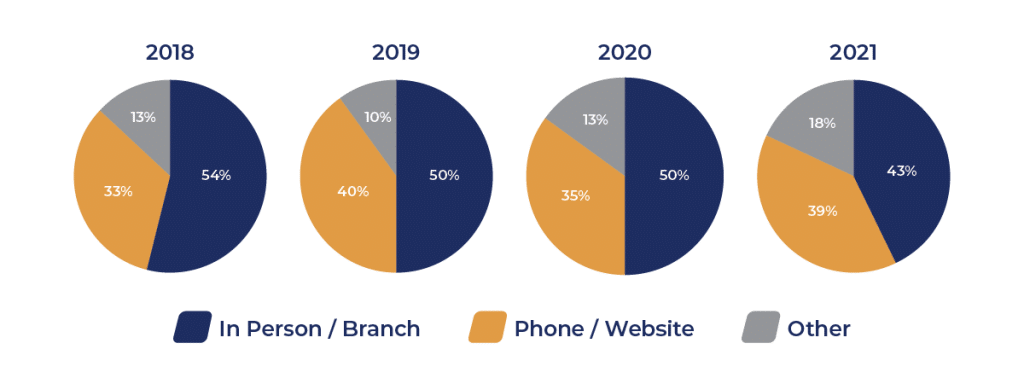

Figure 3: Non-Branch Channels Increasingly Adopted by Canadians for Seeking Financial Advice

There has been a steady decline of people seeking in-branch financial advice from traditional banks, from 54% in 2018 to 43% in 2021. During that same time period, there was an increase in the percentage of people seeking financial advice via phone and online websites which were hosted by traditional financial institutions. This trend will continue to accelerate with further branch closures and a growing number of consumers seeking digital solutions.

As has been the case with other financial services (trading, investing, insurance, etc), consumers are driving innovation in the mortgage broker channel by demanding digital solutions. The industry has responded with a number of large scale, digital platforms that are creating benefits for the customer, lender, and agent alike.

Digital mortgage brokers are able to offer valuable financial advice and a wide selection of products as they are not beholden to one product as would be the case of dealing directly with one financial institution. Furthermore, given the shifting demographics and tightening credit requirement of traditional banks, the “plain vanilla” conventional prime mortgage is in decline and more complex mortgages are becoming the norm in Canada.

Summary

Digital mortgage brokers are the future of the mortgage originations in Canada. The use of the digital broker channel is growing, and is the leading way for first-time homebuyers to complete their increasingly complex mortgage applications. Furthermore, the young generation, immigrants, and those valuing financial advice and personalized services are being engaged in a way that meets their needs rather than the traditional “one size fits all” approach. As the adoption of technology continues and people show significantly less preference for face-to-face interactions and relationships, there will be ongoing gradual growth of the sector.

Source: BMO Capital Markets, CREA, Statistics Canada, CMHC, Bank of Canada, OSFI, Company Reports

Browse Topic by Interest

Recent Posts at 8Twelve